Introduction

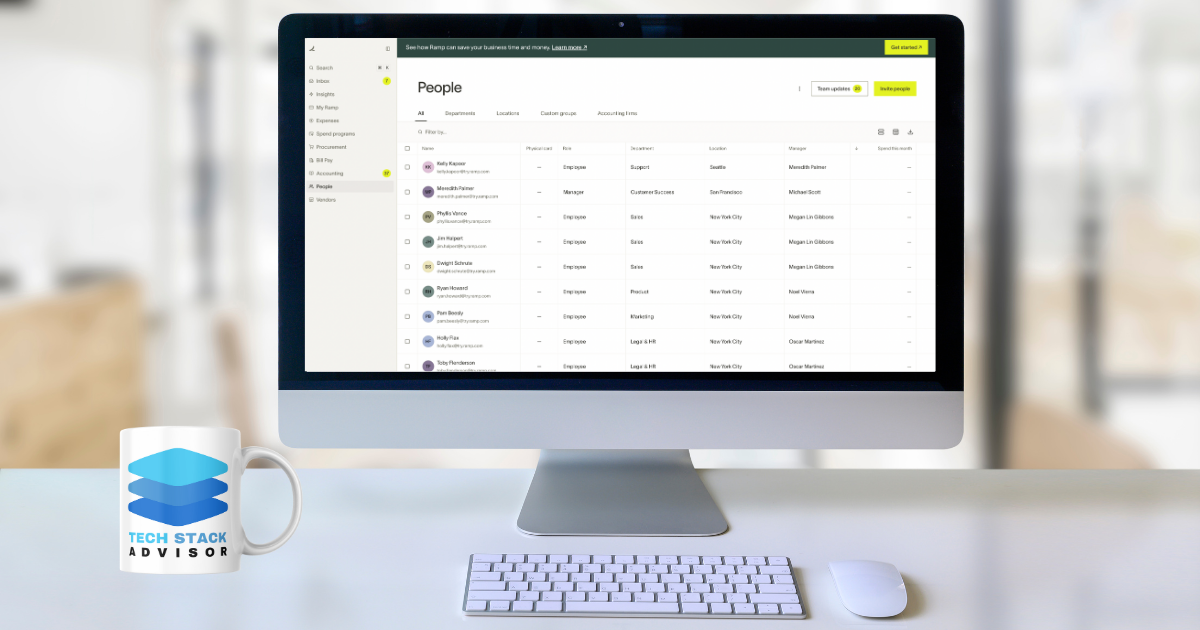

Ramp’s modern finance platform is designed for speed, control, and automation. But to make the most of it, you need to assign the right user roles to the right people. Understanding Ramp’s user roles ensures your team gets the access they need—without compromising security or compliance.

What is Ramp?

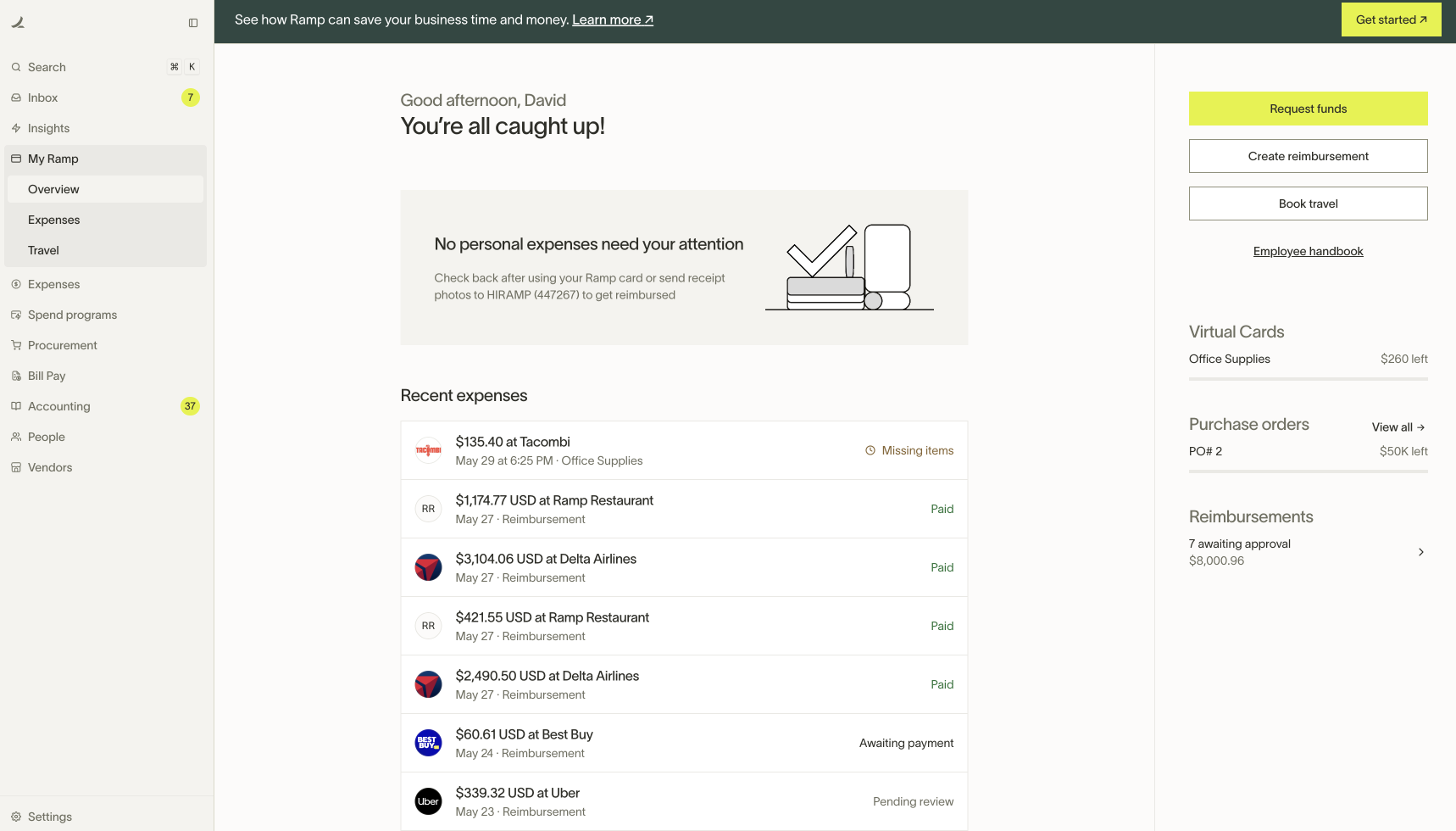

Ramp is a finance automation platform that combines corporate cards, expense management, bill payments, and accounting integrations into a single tool. Built for speed and scale, it helps companies control spend, eliminate manual tasks, and make smarter financial decisions in real time.

As an accredited Ramp Partner, our team helps startups and growing companies configure their Ramp accounts with the right permissions and workflows.

Simplify Spend Management with Ramp

From expense automation to real-time visibility, Ramp helps modern teams move faster and spend smarter.

TL;DR:

- Ramp offers a range of user roles for finance, admin, and employee needs.

- Each role comes with specific permissions to help teams stay secure and efficient.

- TalentLink Advisors can help you map roles, configure access, and train your team.

Why User Roles Matter in Ramp

Assigning the correct user role ensures your team:

- Can perform their tasks without overexposure to sensitive data.

- Follows the company’s approval workflows.

- Maintains internal controls and audit readiness.

Ramp’s user management is flexible, and roles can be combined or restricted as needed.

Overview of Ramp User Roles

Ramp currently offers the following core user roles, each with unique permissions and ideal use cases:

1. Admin

- Full access to all company settings.

- Can issue cards, review transactions, set policies, and manage reimbursements.

- Ideal for Finance Leads, Controllers, or Founders.

2. Bookkeeper

- Read-only access to all financial data.

- Can view transactions, receipts, and vendor data.

- Cannot make changes or approve actions.

- Ideal for external accountants or finance consultants.

3. Manager

- Manages a team’s card usage.

- Can issue cards, approve transactions, and manage spend limits for direct reports.

- Cannot modify company-wide settings.

- Ideal for department heads and budget owners.

4. Cardholder

- Can request and use Ramp cards.

- Can submit receipts, memos, and reimbursement requests.

- Cannot view other users’ cards or company-wide data.

- Ideal for employees with purchasing authority.

5. Reimbursement-only User

- Cannot hold a Ramp card.

- Can only submit reimbursement requests for out-of-pocket expenses.

- Great for team members who rarely make purchases.

6. Travel Booker

- Can book travel on behalf of others using Ramp’s travel platform.

- Cannot spend on a Ramp card unless also assigned as a Cardholder.

- Useful for Executive Assistants and Operations staff.

Scaling a Startup? Start with Ramp

Ramp gives growing teams a smarter way to manage spend, close books faster, and uncover savings - without slowing down.

Additional Admin Permissions

Ramp also allows Admins to assign specific feature-based permissions, including:

- HRIS Integrations – Configure employee directory syncs.

- Accounting Integrations – Set up tools like QuickBooks, Xero, or NetSuite.

- Approval Policy Management – Define approval chains and spend rules.

- Custom Role Creation (Enterprise only) – Build granular access levels based on department or function.

Ramp Expert Tips

- Pair the Cardholder role with Manager permissions for team leads who need to oversee others’ spend.

- Assign Bookkeeper to your CPA or fractional finance partner for real-time visibility.

- Use Reimbursement-only access for hourly workers or contractors.

- Always review user access quarterly to align with team changes or role shifts.

Putting It All Together

- Automate approvals: Build smarter, tiered approval policies so high-volume, low-risk purchases don’t require exec-level review.

- Tag vendors for better reporting: Use vendor tags to classify spend and create cleaner financial insights.

- Enable Slack notifications: Activate Slack alerts for real-time updates on card transactions and approvals.

- Centralize accounting with integrations: Sync Ramp to QuickBooks, Xero, or NetSuite to streamline bookkeeping.

- Empower managers: Equip team leads with the Manager role plus budget oversight to drive accountability.

- Quarterly access reviews: Review and adjust user roles quarterly to match org chart changes and security best practices.

Ramp’s user roles allow companies to maintain strong internal controls while giving each team member the access they need. With the right setup, you can reduce fraud risk, streamline audits, and improve visibility across departments. while giving each team member the access they need. With the right setup, you can reduce fraud risk, streamline audits, and improve visibility across departments.

As accredited Ramp Partners, TalentLink Advisors can help you configure user roles, train your team, and align Ramp with your broader HR and People stack.

Ready to Set Up Ramp the Right Way?

Our team will connect you with a dedicated Ramp onboarding specialist who will personally walk you through the application process and ensure everything is set up correctly from day one.

Curious if Ramp is Right for You?

See how Ramp can streamline your spend management and uncover hidden savings with a personalized demo.