Overview

Whether you’re a finance leader building an expense policy from scratch or a People Ops team refining one for a growing startup, your goal is the same: keep spending aligned with company goals while reducing manual admin work. A clear expense policy also reduces ambiguity for employees and helps leadership maintain control without micromanaging.

This expert guide walks you through how to create an effective, scalable expense policy for your company. We also introduce a powerful shortcut - Ramp’s free Expense Policy Template which helps you build a professional policy in minutes.

TL;DR

- A strong expense policy sets clear boundaries while empowering employees to spend responsibly

- Your policy should include: categories, limits, approval workflows, and documentation rules

- Ramp's free Expense Policy Template helps you skip the blank page and build fast

Core Elements of a Business Expense Policy

Overview / Purpose and Scope

Open with a clear description of your expense policy’s intent. Define who it applies to (e.g. employees, contractors) and why it matters - typically to control spending, streamline reimbursements, and stay compliant.

Different stakeholders often require different expense policy rules. For example, executives and department heads may need broader spend limits and greater flexibility, while contractors or field staff might be limited to per diems and capped travel budgets.

Before launching into the Ramp Expense Policy Template, list out your key stakeholder groups and define their specific policy needs. This will ensure your policy is tailored, scalable, and easy to enforce.

Expense Categories

List out all categories where spending is allowed and define them clearly. Break them into subcategories for additional organization and clarity:

- Travel: Airfare, mileage or car rental, hotels, Uber / Lyft, other incidentals

- Meals & Entertainment: Meal per diem, client meals

- Office Supplies & Equipment

- Software Subscriptions

- Training & Development: Conferences, memberships

- Wellness Stipends

- Client-Related Expenses

Define limits and approval rules where needed and discuss internally to ensure alignment between all departments and leadership.

Expense Reporting and Approval

Outline how employees should submit expenses:

- What platform to use (e.g. Ramp)

- When expenses must be submitted (e.g. within 5 business days)

- Who reviews and approves them (e.g. manager, finance team)

Documentation Requirements

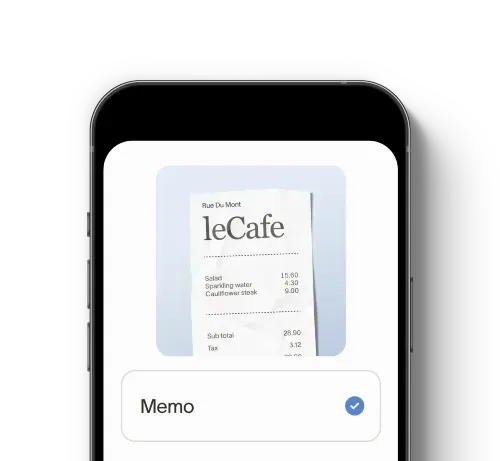

Set expectations for what proof is needed:

- Itemized receipts (with or without a memo to explain the charge)

- Invoices

- Card statements (if applicable)

Ramp allows employees to upload receipts via SMS or the Ramp mobile app and automatically matches them to transactions.

Non-Reimbursable Expenses

Avoid gray areas by listing exclusions explicitly:

- Personal purchases

- Meals without business justification

- Over-the-limit expenses

- Late submissions

- Items without documentation

- Fines or penalties

- Unauthorized vendor purchases

Expense Reimbursement

Explain how reimbursements work:

- How long it typically takes (e.g. 3–5 business days)

- Method of payment (e.g. ACH)

- Reporting deadlines to qualify for reimbursement

Save Time Building Your Expense Policies

Leverage Ramp's Free Expense Policy Template to build a structured expense policy based on industry best practices without the headaches.

Best Practices for Building an Expense Policy

- Be Clear: Avoid jargon. Write with the end user in mind.

- Be Current: Revisit quarterly or biannually as business needs evolve.

- Be Accessible: Host on an intranet, Ramp, or employee handbook.

- Be Helpful: Include a contact for policy questions.

Mini-Case Study: The Harvard Expense Policy

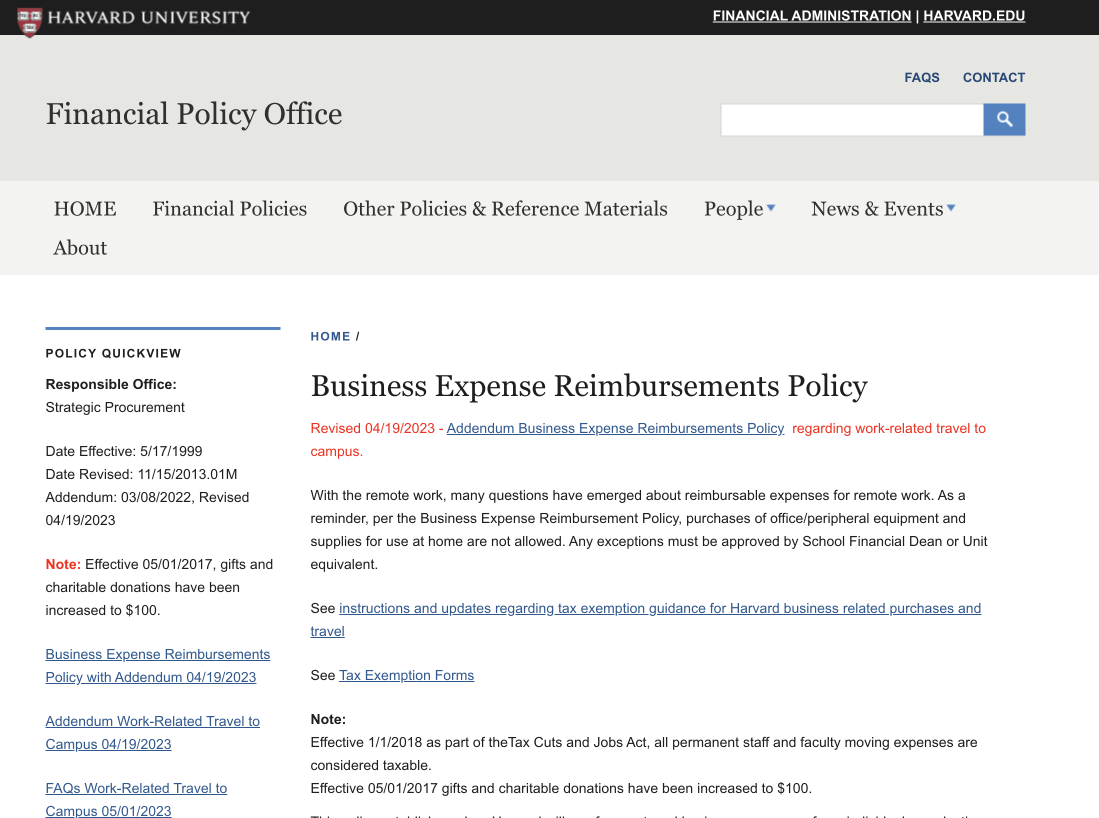

Harvard University’s business expense policy highlights the risks of outdated, fragmented documentation. Originally written in 1999, the policy has been revised multiple times, requiring employees to navigate several pages and PDFs to piece together current rules.

- Employees must reference multiple addendums to understand what qualifies as a reimbursable expense.

- Links redirect to standalone documents with varying update dates (2017, 2023), creating confusion.

- The lack of a unified, real-time policy resource increases the risk of noncompliance and errors.

The Three Pillars of an Effective Expense Policy

An effective expense policy doesn’t just explain what employees can or can’t spend money on; it enables responsible decision-making before, during, and after purchases. The best policies provide just enough structure without creating bottlenecks or excessive approvals.

- Before Spending: Use pre-approvals for specific teams or vendors.

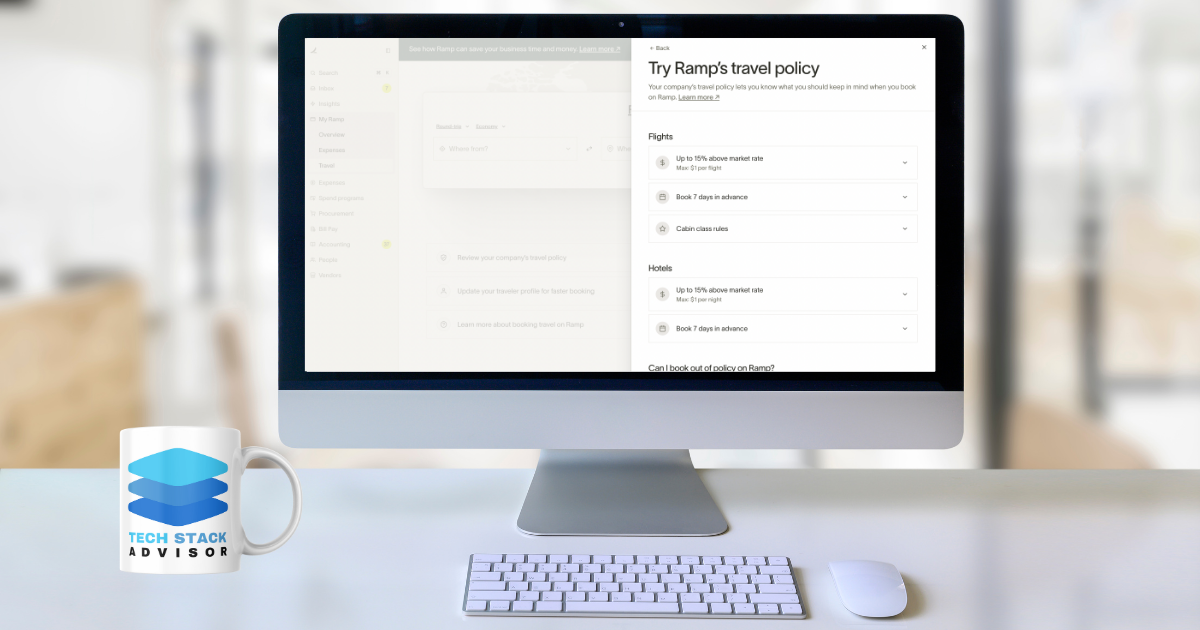

- When Spending Happens: Ramp flags or blocks out-of-policy expenses in real time.

- After Spending: Open channels for documentation and feedback.

Assigning Roles in Your Policy

Create clarity by defining 3 primary roles:

- Cardholders: Spend company funds and upload receipts.

- Card Managers: Review transactions, ensure policy adherence.

- Admins: Set policies, onboard teams, and oversee approvals.

Ramp supports role-based permissions and custom spend limits for each role.

Keeping Your Policy Up to Date

Treat your policy as a living document. Schedule quarterly reviews or adjust in real time as new use cases emerge (e.g. more client travel, new budget owners).

This ensures your policy grows with the business and keeps employees aligned.

How Ramp Automates Expense Policy Compliance

Ramp helps enforce your policy without creating extra work:

- Receipt uploads via SMS or mobile app

- AI-generated expense categories and memos

- Integrations with Gmail, Uber, Lyft, and more

- Auto-matching receipts and transactions

- Approval routing based on your org chart

- Audit trails for compliance reviews

Curious if Ramp is Right for You?

See how Ramp can streamline your spend management and uncover hidden savings with a personalized demo.

Putting It All Together

The best expense policies don’t just document rules - they shape your culture. A clear policy, powered by smart automation, helps your team spend responsibly while staying compliant.

If you’re ready to create or update your policy, start with Ramp’s free Expense Policy Template. It’s fast, flexible, and backed by modern finance tools that scale with your business.