Introduction

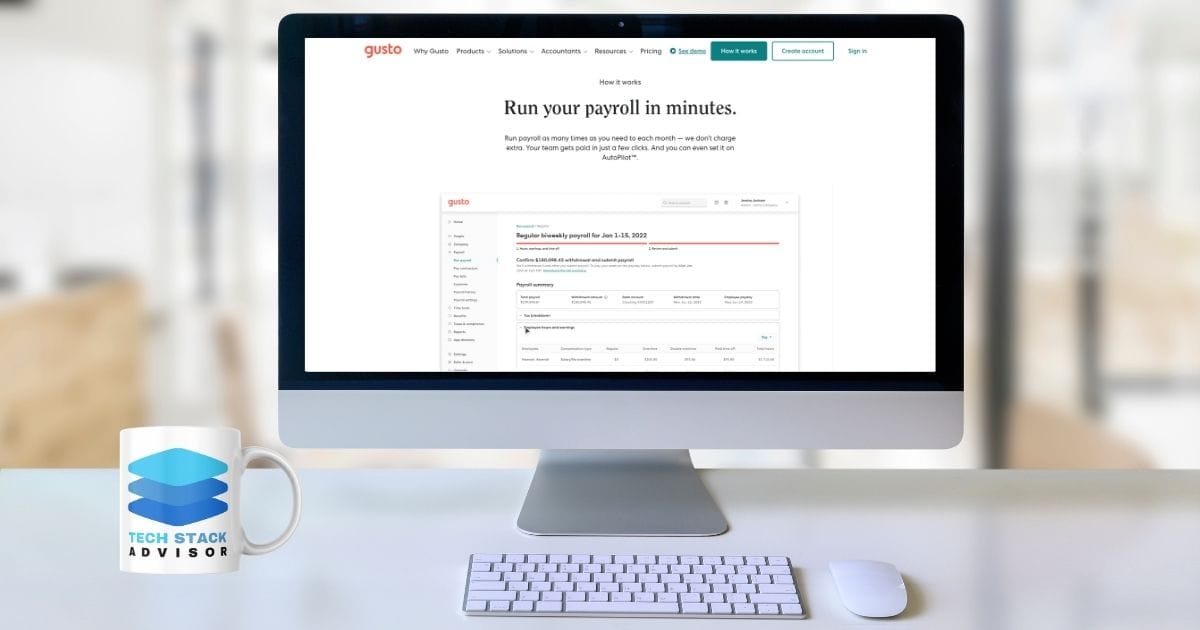

Payroll can be complicated for small businesses, but Gusto makes it straightforward by simplifying payroll, taxes, and employee benefits. This enables small business owners to efficiently manage their workforce without hassle.

TL;DR

Gusto provides streamlined, automated payroll solutions for small businesses:

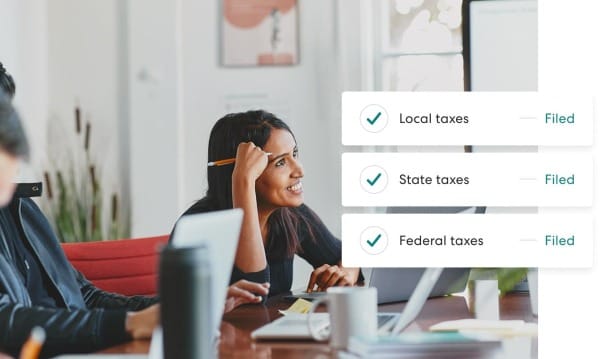

- Automate payroll processing and tax filings

- Easy management of employee benefits

- Smooth integration with other business tools

What is Gusto Payroll?

Gusto is an online payroll and HR software platform tailored for small businesses. It simplifies complex payroll responsibilities, from onboarding and tax compliance to employee management, reducing costly errors and saving significant time.

Key Features of Gusto Payroll

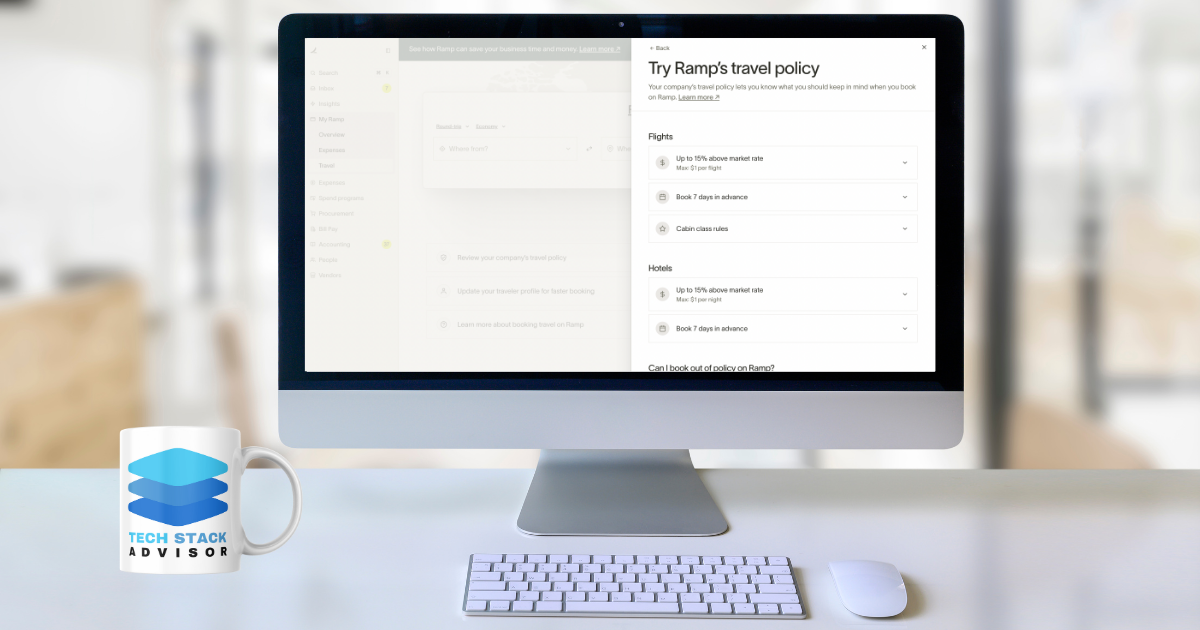

- Automated payroll processing and direct deposits

- Seamless federal, state, and local tax management

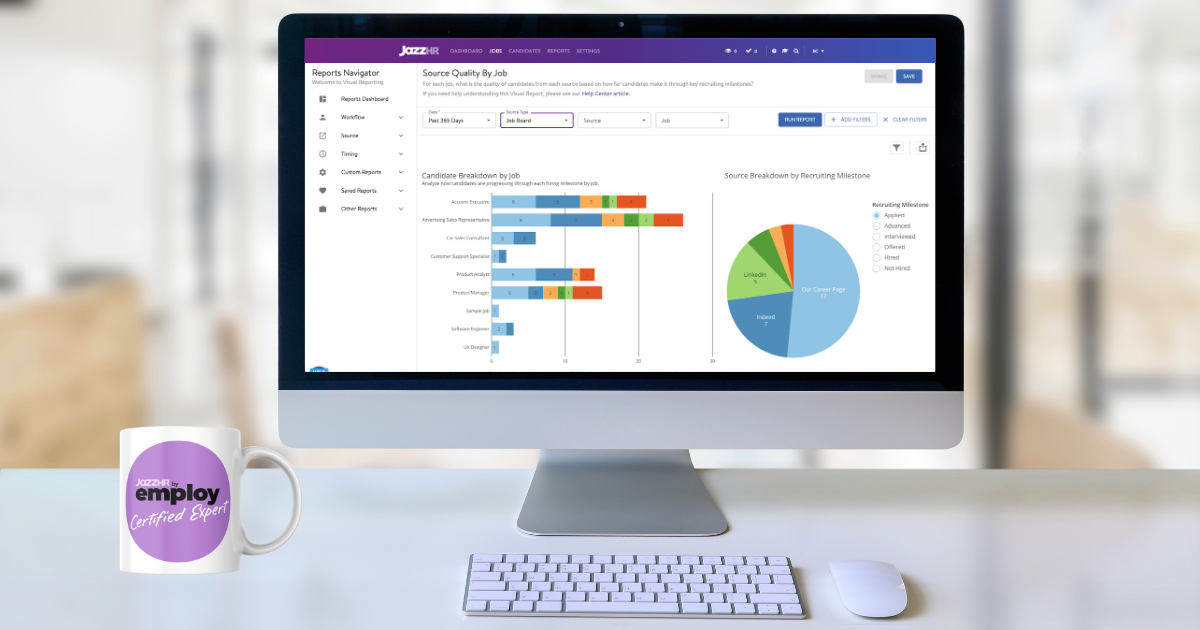

- Insightful payroll analytics and reporting

Common Payroll Challenges for Small Businesses

Small businesses frequently encounter payroll complexities that can drain resources and time. Understanding and addressing these common issues helps prevent costly errors and improves overall business efficiency.

Common Payroll Challenges Include:

- Complicated tax rules and deadlines

- Accurate payroll processing

- Tracking hours, overtime, and leave

- Adhering to changing compliance laws

How Gusto Addresses Payroll Challenges

Gusto directly tackles common payroll difficulties, making payroll management straightforward and error-free.

- Automatic payroll calculations and tax filing

- Simplified onboarding and intuitive time tracking

- Provides timely compliance alerts and automatic updates

Step-by-Step Guide to Getting Started with Gusto

Setting up Gusto for your small business is straightforward, ensuring minimal disruption to your operations while significantly improving your payroll processes.

Steps to Set Up Gusto

- Create your Gusto account easily online

- Configure employee profiles and payroll frequency

- Run automated payroll effortlessly

Why Work with Gusto People Advisory Certified Partners?

Our team is Gusto People Advisory Certified, meaning we go beyond payroll processing to provide strategic HR and financial guidance. With specialized training through Gusto’s People Advisory Certification, we help businesses optimize their payroll, benefits, and compliance while improving the employee experience.

Best Practices for Maximizing Benefits from Gusto

To get the most out of Gusto’s robust features, follow these proven strategies to enhance your payroll efficiency and compliance.

- Regularly use payroll analytics for budgeting and strategic decisions

- Take advantage of Gusto’s proactive compliance updates

- Utilize Gusto’s customer support for efficient resolution of questions or issues

FAQs about Using Gusto for Payroll

Does Gusto integrate with accounting software?

Yes, Gusto integrates seamlessly with accounting software like QuickBooks and Xero.

Can Gusto handle contractor payments?

Yes, Gusto effortlessly manages payments to both full-time employees and independent contractors.

How secure is Gusto for payroll data?

Gusto prioritizes security with advanced encryption and secure data storage to safeguard payroll information.

What Does a Gusto People Advisory Certified Partner Offer?

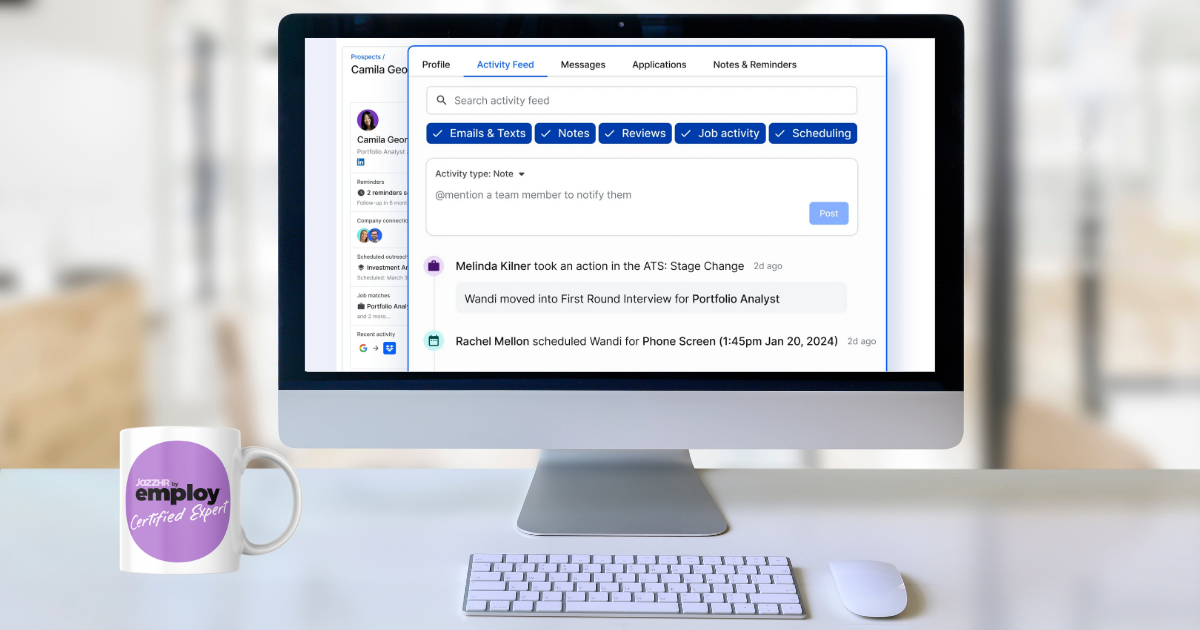

We've helped countless business and HR leaders to setup, optimize, and manage their Gusto payroll. Our team of expert advisors can assist with:

- Strategic Payroll & HR Guidance: We help businesses make data-driven payroll and benefits decisions to align with growth goals

- Employee Experience Enhancement: From onboarding to benefits selection, we guide companies in building attractive compensation packages

- Seamless Financial System Integration: Ensure smooth payroll operations with accounting software, retirement plans, and health benefits integrations

Putting It All Together

Gusto simplifies payroll management for small businesses, reducing administrative burdens and improving accuracy and compliance. Its automation features and easy integrations allow small businesses to focus on growth and productivity rather than payroll complexity.