Introduction

Ensuring compliance across multiple countries can be overwhelming for businesses managing global teams. With constantly changing regulations and complexities, Deel offers an efficient solution, helping organizations effortlessly maintain payroll and HR compliance worldwide.

TL;DR

Deel simplifies international compliance by:

- Centralizing payroll compliance management

- Automating updates for regulatory changes

- Providing expert local payroll support

What Makes Global Compliance So Challenging?

Compliance across international boundaries involves navigating diverse labor laws, handling varied payroll regulations, and maintaining accurate records. Mismanagement can lead to fines, legal complications, and damage to a company's reputation.

5 Ways Deel Simplifies Global Compliance

1. Automated Compliance Updates

Deel continuously tracks regulatory changes in real-time across various countries. It automatically updates payroll calculations and processes accordingly, minimizing the administrative burden and reducing the risk of human error.

For instance, if employment tax rates change in Germany or Brazil, Deel will adjust your payroll processes instantly without manual intervention.

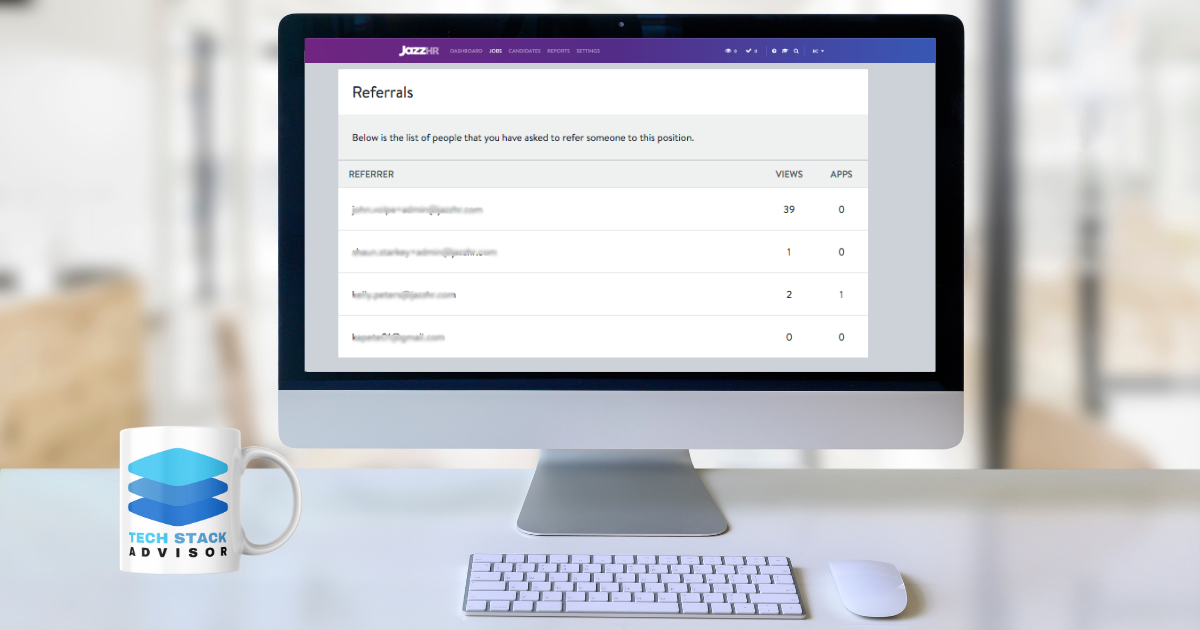

2. Local Payroll and HR Expertise

Deel connects businesses with payroll and HR professionals who specialize in local compliance laws. These experts understand nuanced local regulations, ensuring your payroll processes accurately reflect local labor laws.

For instance, Deel’s payroll experts in Europe ensure adherence to EU labor directives and GDPR requirements.

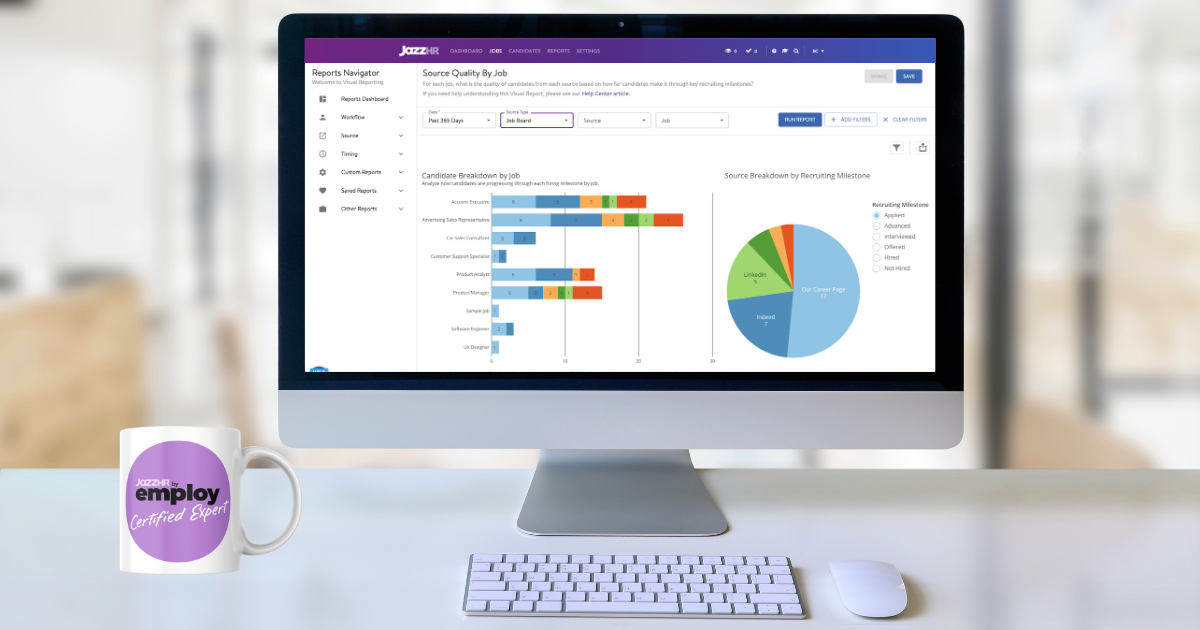

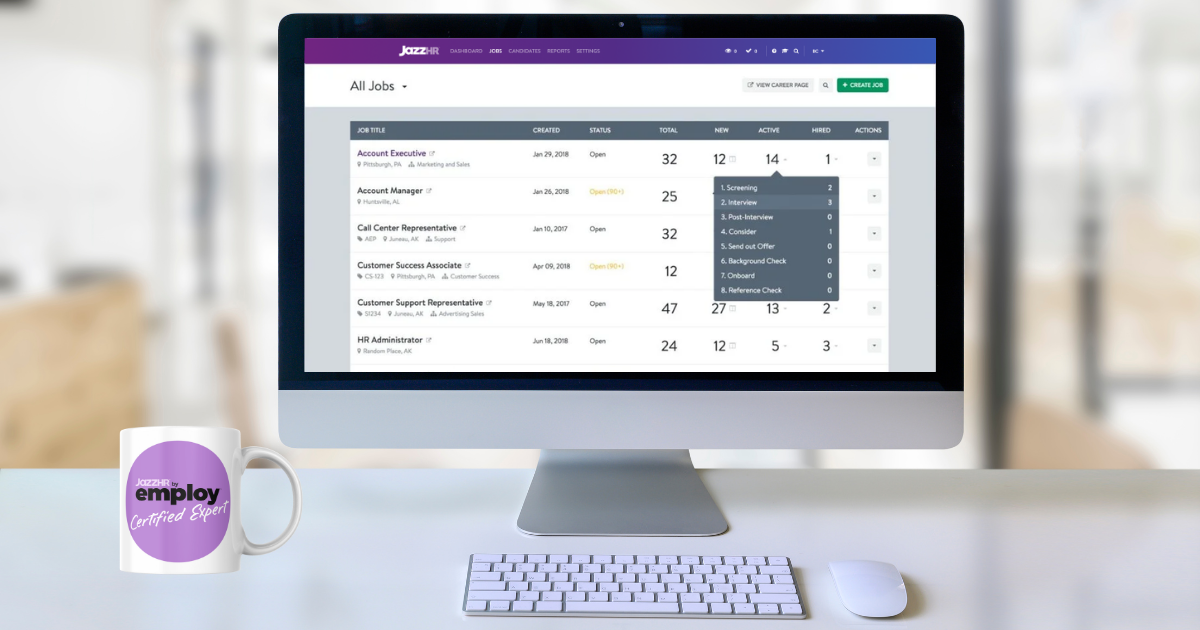

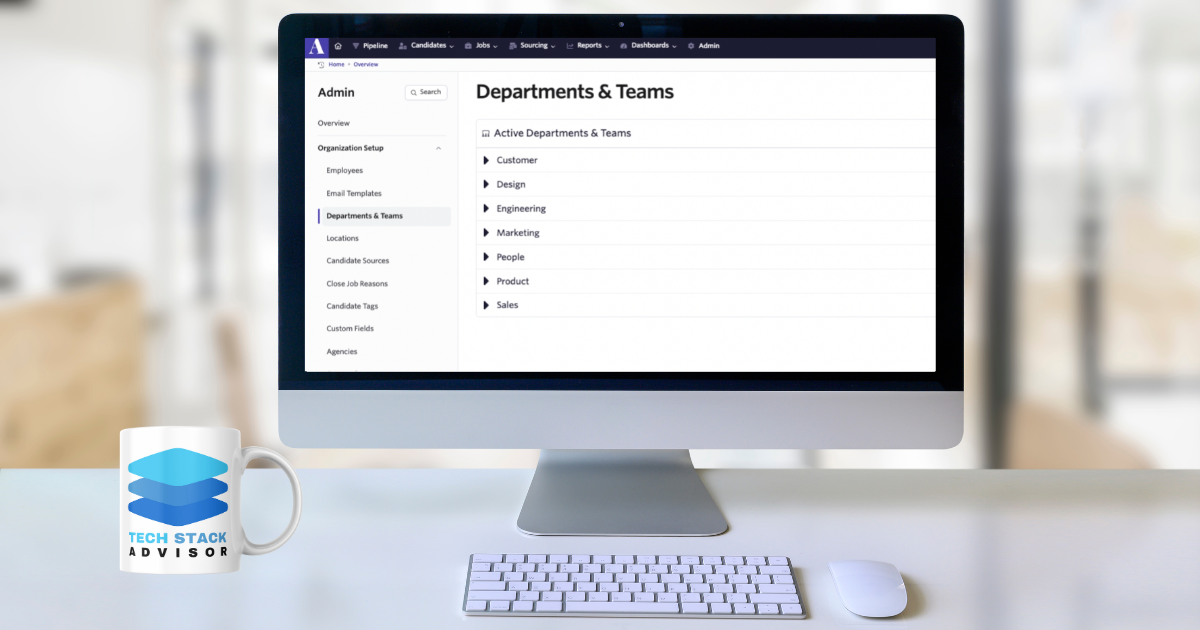

3. Centralized Compliance Management

Deel provides a single platform that centralizes compliance tasks, removing the complexity of managing multiple international systems. All payroll-related documentation, employee data, and compliance information are accessible from one intuitive dashboard.

For example, companies can manage employees in Canada, Brazil, and Japan all from Deel's unified interface, drastically simplifying reporting and auditing processes.

Managing international payroll doesn’t have to be complex. See how Deel can streamline payments, compliance, and hiring across borders.

➙ Book a Demo

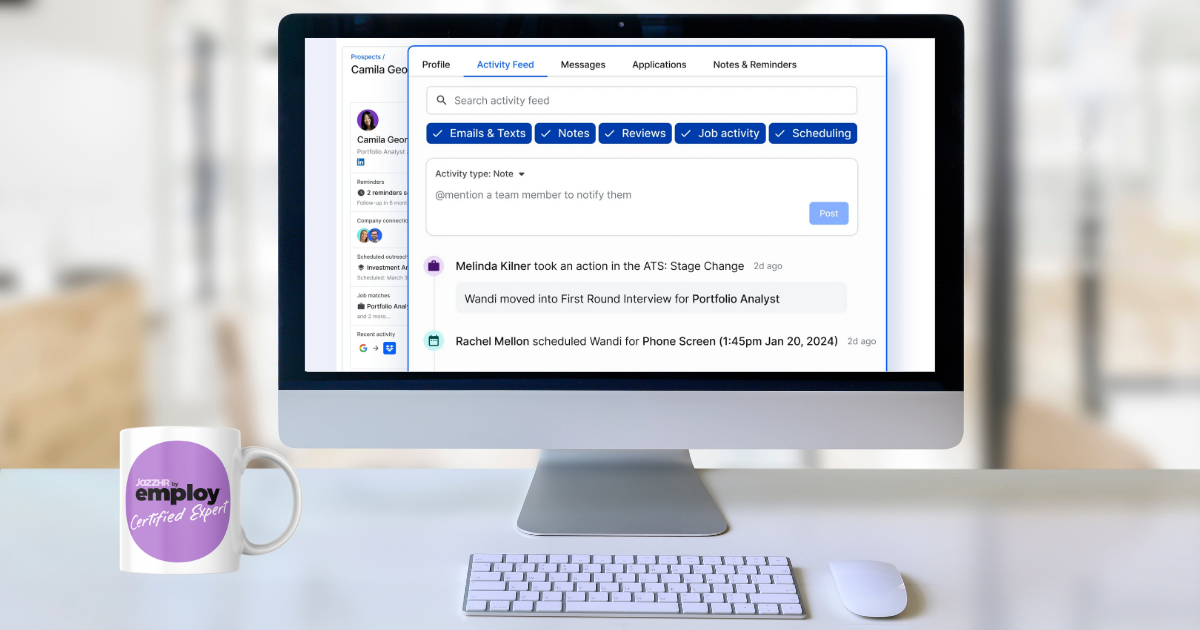

4. Real-Time Compliance Notifications

Companies receive immediate notifications about significant regulatory updates, helping them proactively address compliance issues before they become problematic.

For instance, if new labor laws are introduced in Australia, Deel alerts businesses instantly, enabling timely adjustments to payroll processes.

5. Comprehensive Legal Support

Deel includes extensive legal documentation tailored to local employment laws, including contracts, payroll records, and compliance reports. This documentation reduces complexity and provides clarity for international HR processes.

For example, Deel provides pre-prepared employment agreements compliant with employment regulations in countries such as Brazil and India, simplifying the hiring process significantly.

How to Implement Deel for Optimal Compliance

To maximize Deel’s compliance advantages, follow these practical steps:

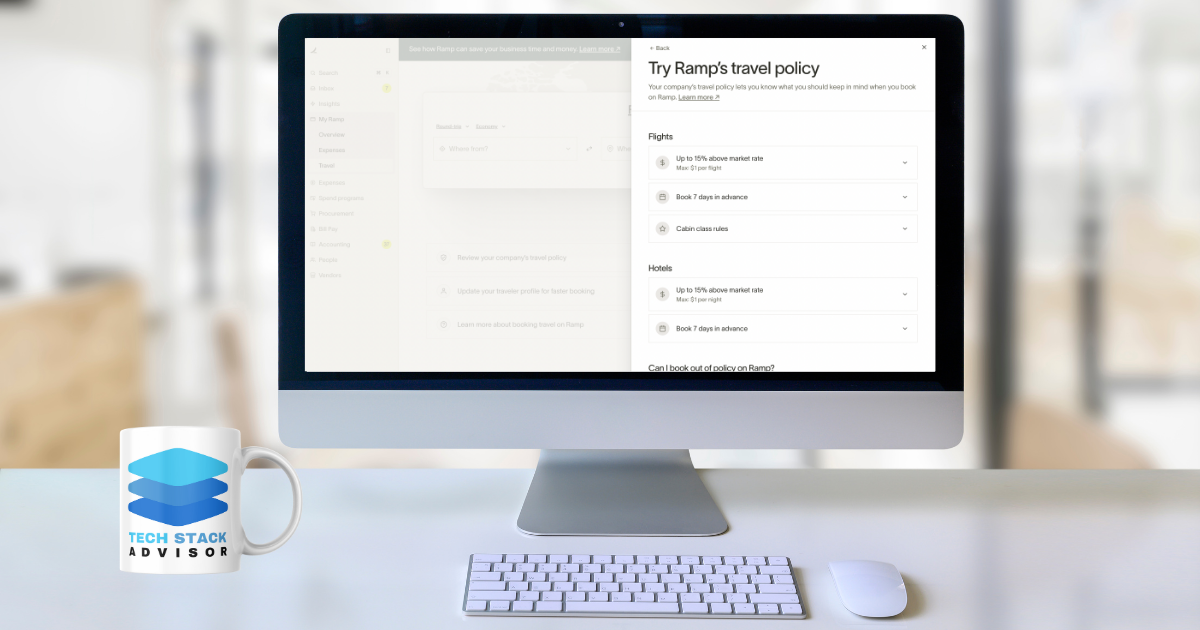

- Create and configure your Deel account online.

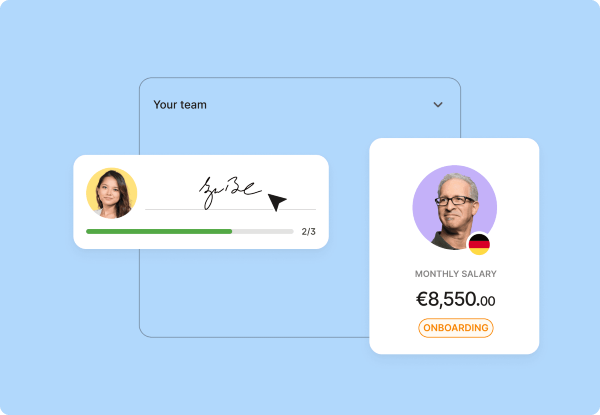

- Utilize Deel’s onboarding system for international hires.

- Regularly review Deel’s compliance reports and analytics for ongoing accuracy and compliance.

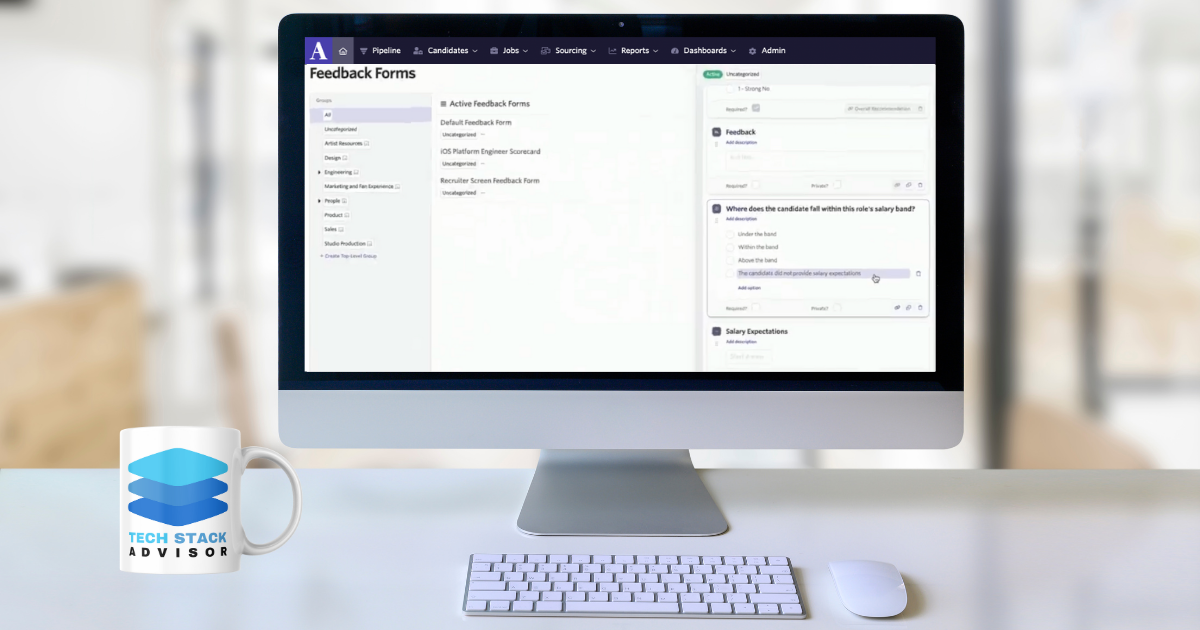

Decrease Onboarding Time From Hours To Minutes

Onboarding an employee in Berlin is totally different from onboarding an employee in Buenos Aires. Fortunately, Deel localizes every item for you - from minimum wage to country-specific documentation requests - enabling your hiring team to onboard anyone, anywhere quickly and compliantly.

FAQs About Using Deel for Compliance

Does Deel handle local taxes globally?

Yes, Deel automatically calculates, files, and manages local taxes according to specific regional payroll regulations, helping your business remain fully compliant.

What happens if regulations change suddenly?

Deel immediately adjusts payroll processes and employment contracts in response to regulatory changes, ensuring continuous compliance and minimizing business disruption.

Can Deel integrate with other HR software?

Yes, Deel integrates with numerous popular HRIS and ATS systems, providing seamless data synchronization and improved compliance across HR workflows.

Putting It All Together

Deel significantly eases the compliance burden for businesses with global teams. By automating regulatory updates, offering local expertise, centralizing compliance management, and providing comprehensive legal support, Deel ensures that businesses remain compliant and efficient as they scale globally.